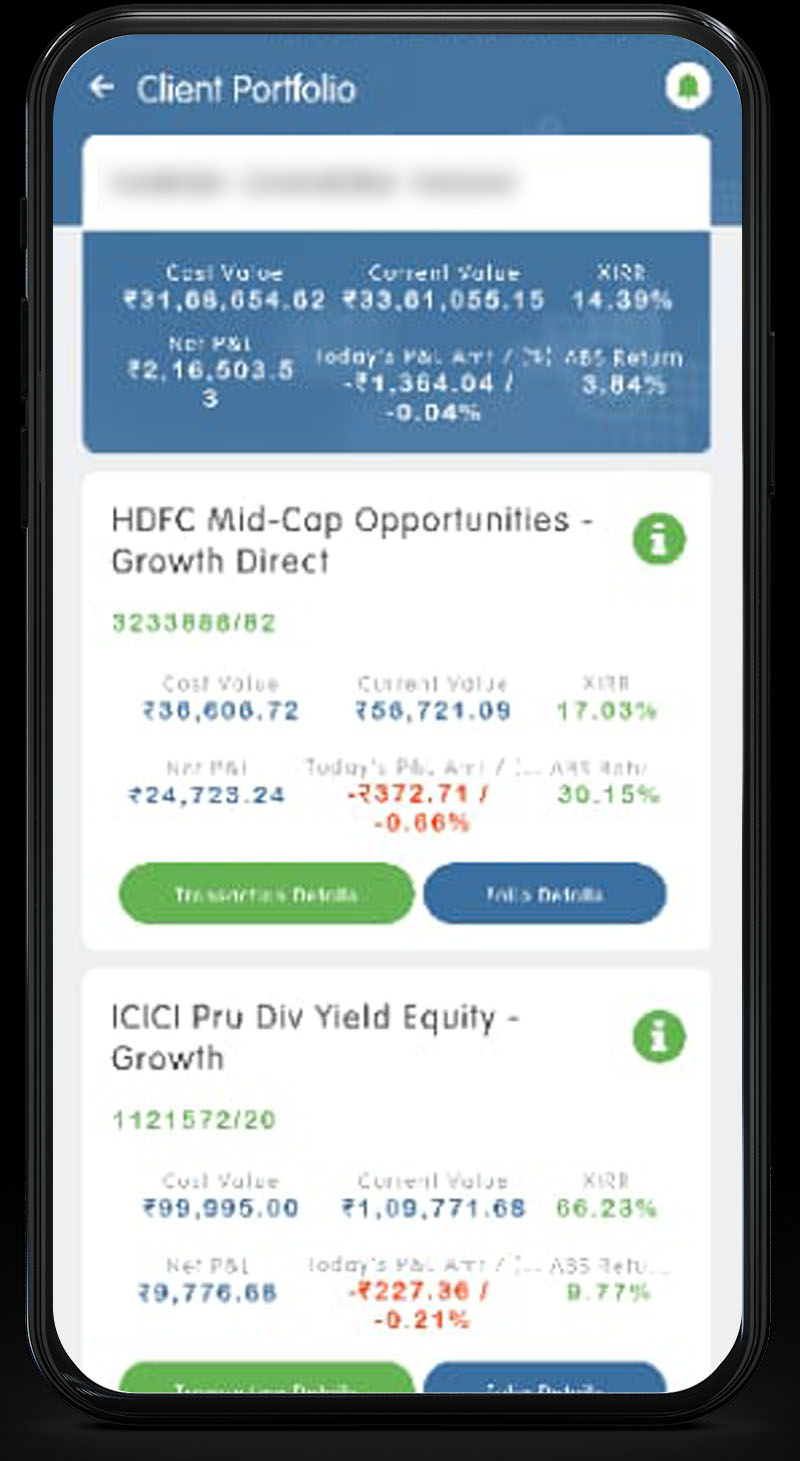

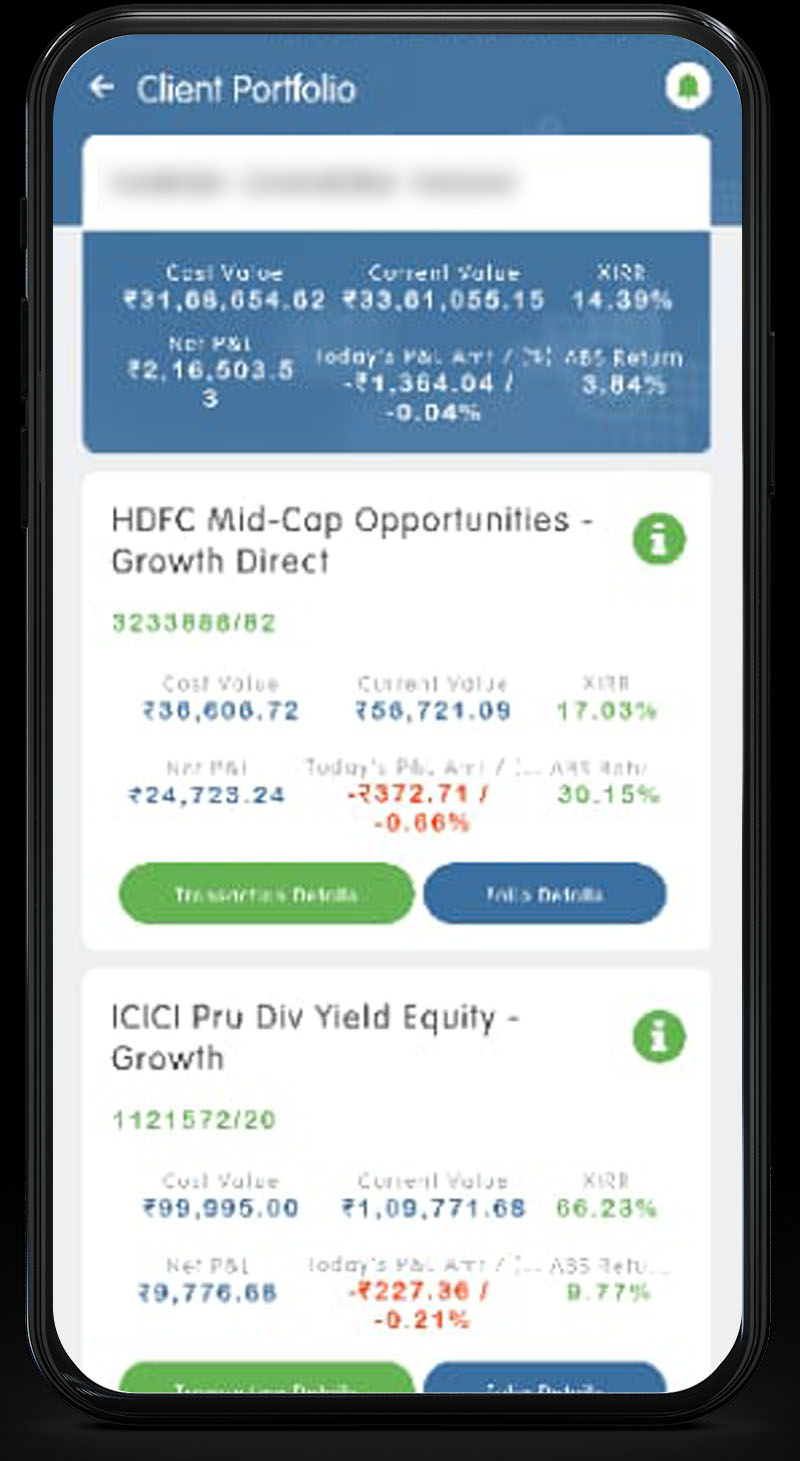

Track your Investment

anytime from anywhere

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s.

Start investing now and enjoy the returns for a lifetime based on a goal-based investment approach.

Get Started Contact Us

Monthly Amount |

|

|

No. of Years |

|

|

Expected Return |

|

|

Welcome to Fintech Wealth IMF LLP where we provide expert financial advice and guidance to our clients to help them achieve their financial goals. We are a team of qualified and seasoned financial advisors with a track record of delivering innovative and customized wealth management solutions to our clients.

Our mission is to serve the society by helping individuals, households and businesses make informed financial decisions to meet their wealth-goals in life. We strongly believe in universal access to professional financial advice and guidance, regardless of their level of income.

Know MoreThe Products we offer are:

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s.

At Fintech Wealth, we believe that the key to successful financial planning and investment management is a clear and structured work process. Our team of experienced financial advisors follows a six-step process to ensure that we provide our clients with high-quality, customized financial solutions.

The first step in our work process is an initial consultation with a potential client. During this meeting, we take the time to understand the client's financial goals, objectives, risk tolerance, and current financial situation. This information forms the basis of our customized financial plan for the client.

Based on the information gathered during the initial consultation, our team of financial advisors will develop a customized financial plan for the client. This plan will include recommendations for investments, retirement planning, insurance coverage, and any other financial goals that the client may have.

Once the financial plan has been developed, we will present it to the client for review. This is an opportunity for the client to ask questions and provide feedback on the plan. We work closely with the client to make any necessary adjustments and ensure that the plan meets their needs.

After the financial plan has been finalized, we will begin implementing the investment strategy outlined in the plan. This may involve selecting specific investment products and opening accounts with investment custodians on behalf of the client.

Once the investment strategy has been implemented, we continue to monitor the client's portfolio and make adjustments as needed. This may involve rebalancing the portfolio to ensure that it remains aligned with the client's risk tolerance and investment objectives.

To ensure that the financial plan remains aligned with the client's needs over time, we conduct regular client reviews. During these reviews, we review the client's financial situation and goals and make any necessary adjustments to the financial plan.

By following this structured work process, we are able to provide our clients with the personalized financial solutions they need to achieve their financial goals. Our team of financial advisors is committed to working closely with each client to develop a customized financial plan that meets their unique needs and objectives. Contact us today to schedule an initial consultation and learn more about our work process.

Risk taking is an important aspect when it comes to investing money. Know your risk taking capacity to decide what funds you should invest in.

Know Your Risk Profile